Congratulations on completing the property transfer for your new home, and now owning a house of your own. Next, you may soon receive a property tax bill from the government. If you're not familiar with property taxes in California, I recommend reading my related article:Key Facts About Property Taxes in Californiafirst

In addition to congratulations, I'd like to offer you a friendly reminder: if the house is your primary residence, hurry to apply for the homeowner's property tax exemption to save on property tax expenses. In California, homeowners who own and occupy their residence as their principal place of residence as of January 1st might be eligible for an exemption of up to $7,000 in assessed value, potentially saving around $70-80 on property taxes annually.

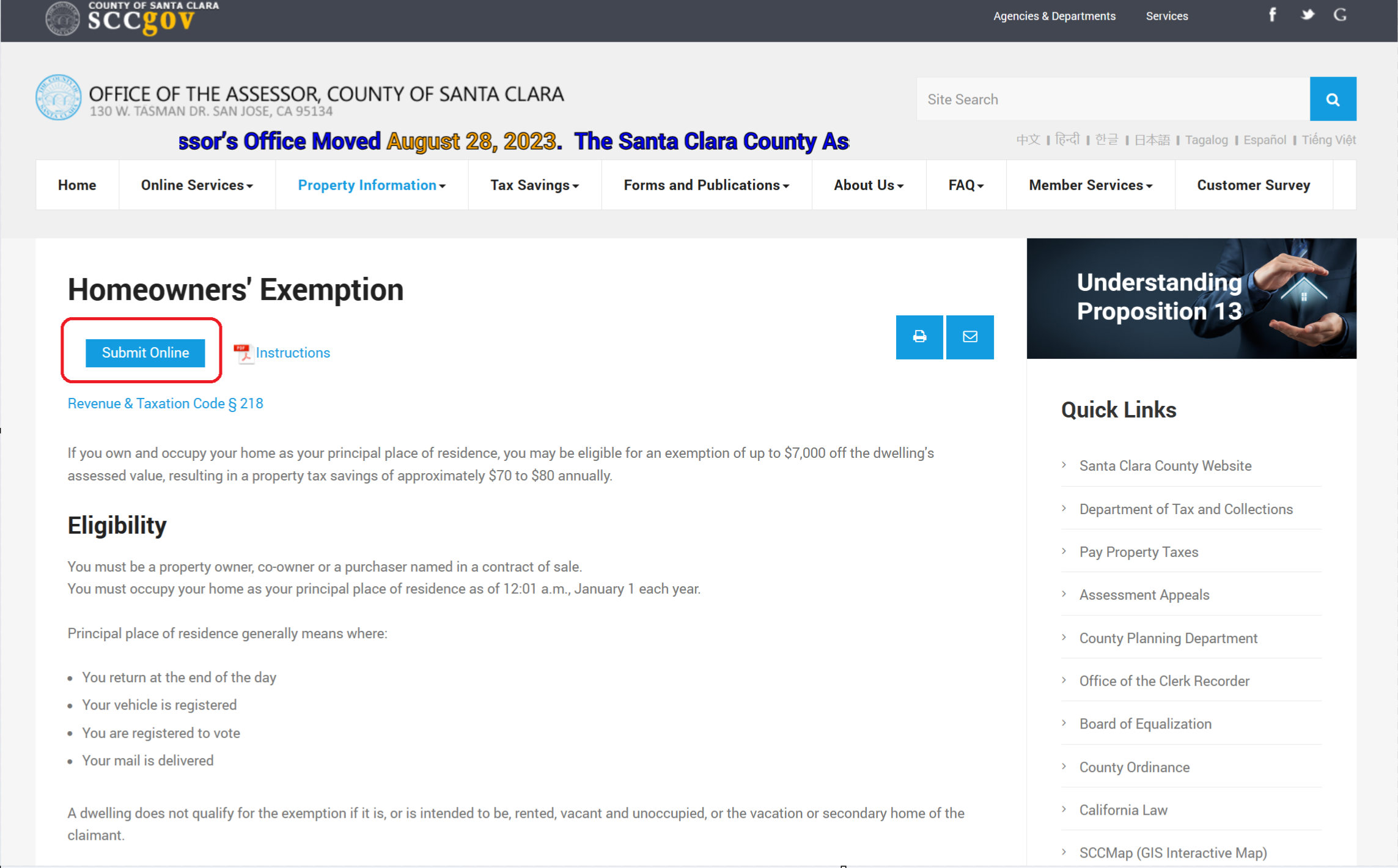

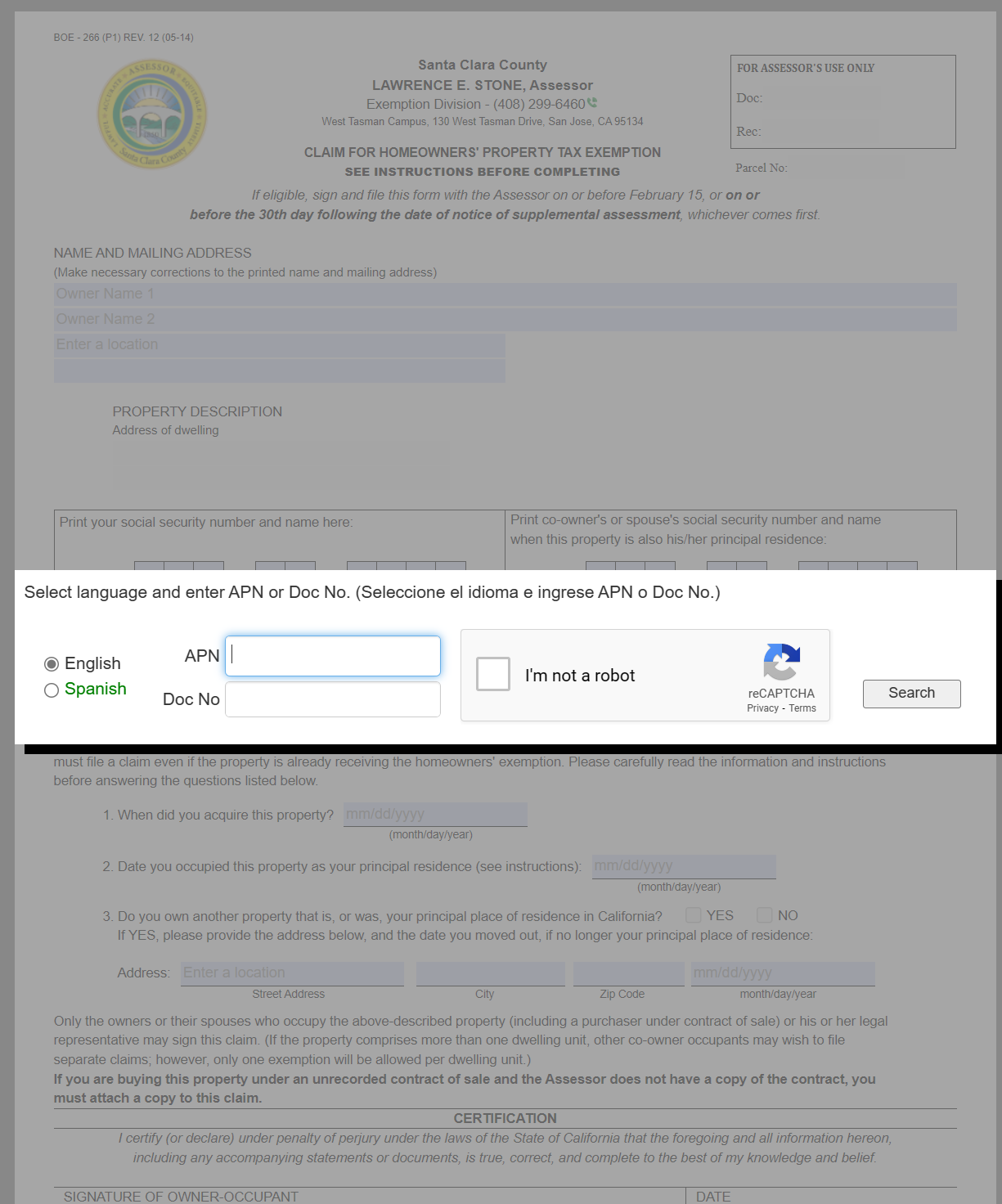

To apply for the homeowner's property tax exemption, homeowners should contact the County Assessor's Office in the county where the property is located. You can typically find the application form by searching online using the format: "county name + homeowners exemption form," such as "Santa Clara County homeowners exemption form." Once you've located the form, you'll need to fill it out accurately and submit it to the appropriate office along with any required documentation. The County Assessor's Office will then review your application and notify you of the status of your exemption.

The following image is a screenshot of the explanation regarding the homeowner's property tax exemption in Santa Clara County. Clicking "Submit Online" allows you to fill out the form online. Before filling out the form, please have the APN number (Assessor Parcel Number) ready, which can be found on your property tax bill.

The image below is an application form for the homeowner's property tax exemption in Alameda County, provided for reference only. If needed, please download it from the official website of the Alameda County Assessor.

Here are some important reminders for your attention:

1.You only need to apply once, and you'll enjoy the exemption every year thereafter.

2.Apply as soon as possible after purchasing your home. If you apply before February 15th, you'll receive a full exemption for the current year. If you apply between February 16th and December 10th, you won't receive a full exemption; the specifics may vary, so it's best to consult with the County Assessor's Office. In Santa Clara County, you can receive an 80% exemption during this period.

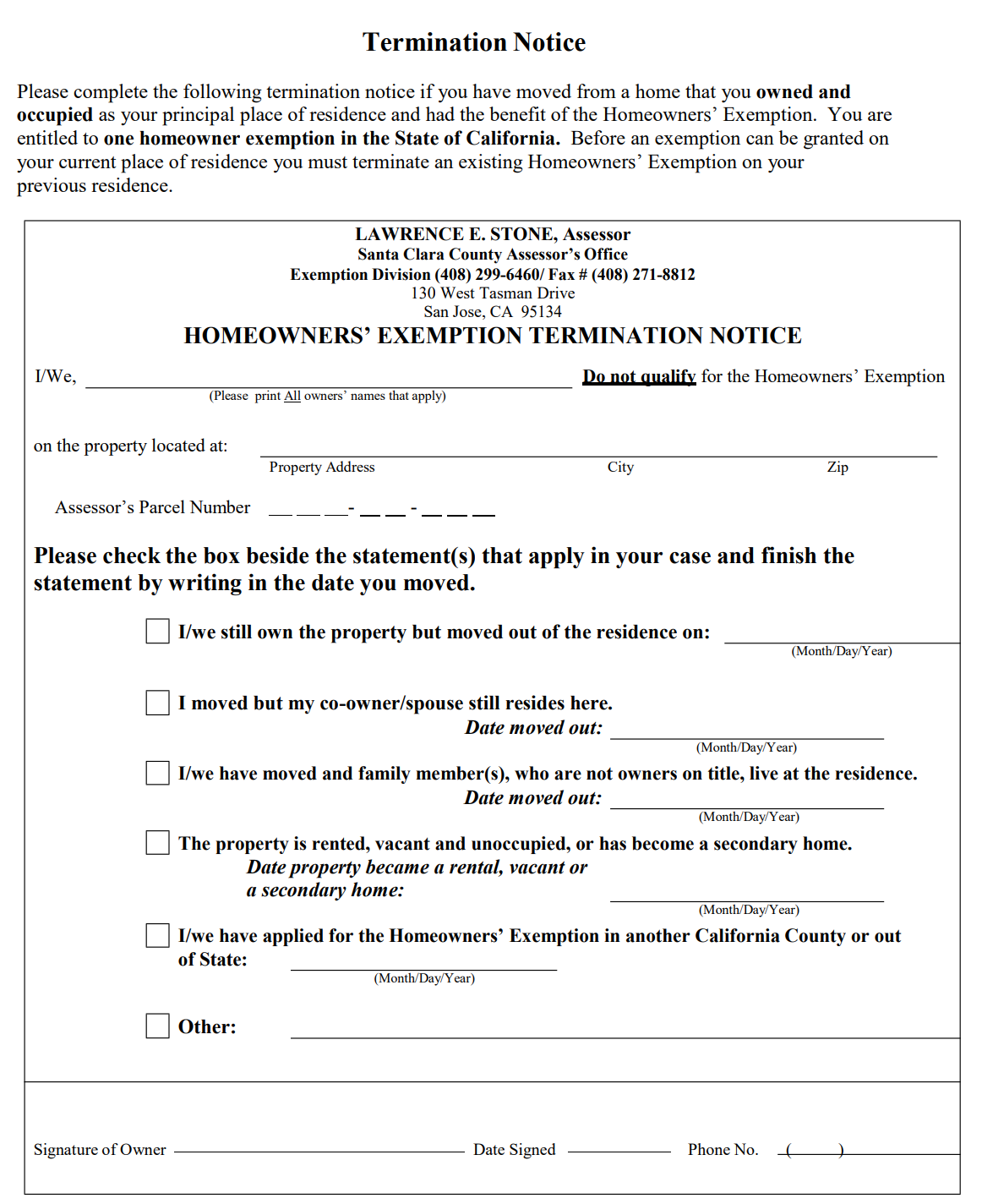

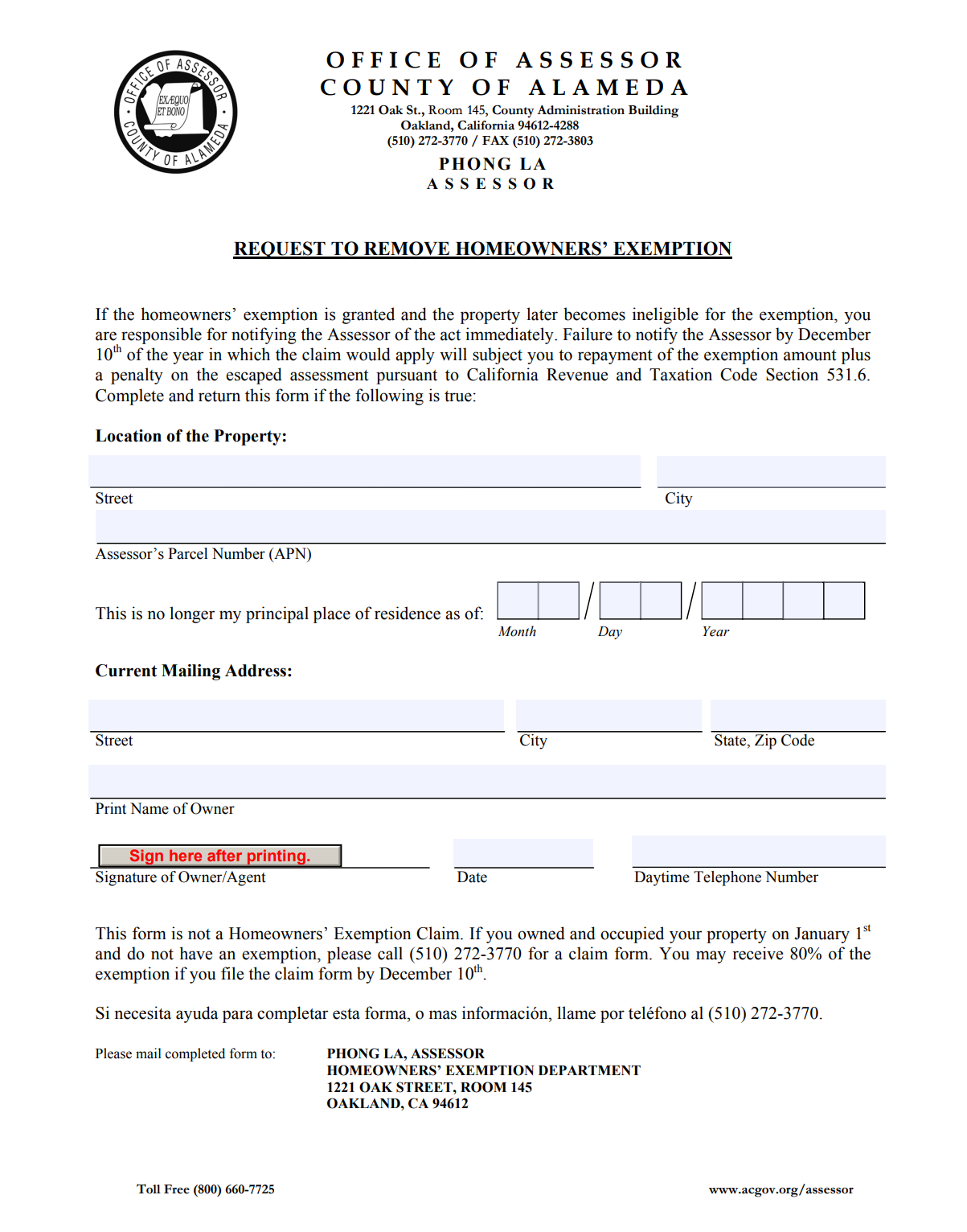

3.If you move or no longer use the property as your primary residence, you need to notify the County Assessor's Office promptly to request the cancellation of your homeowner's property tax exemption. December 10th is the deadline, after which penalties may apply. Below is a sample Termination Notice reference only. If needed, please contact your local County Assessor's Office for the most up-to-date form.