It's actually not difficult to understand the financial status of a neighborhood's HOA before buying a house. You just need to carefully read the annual budget reports to get a comprehensive understanding of the community's finances. This way, you won't be caught off guard by special assessments of five to twenty thousand dollars. I have an example of such an annual budget report in my hand, which is about forty to fifty pages long. I always go through these details with my clients before they buy a house. Today, I'd like to share some key information with you to help you avoid any financial pitfalls related to the HOA.

First, you should understand that the monthly HOA fees you pay, which can range from tens to hundreds of dollars, are allocated for two purposes. The first purpose is the operating fund, which is used to cover the daily public expenses of the community.

For example, as shown on this page, there are Administrative & Office Expenses.

There are also Contract & Maintenance Expenses, with specific maintenance tasks itemized.

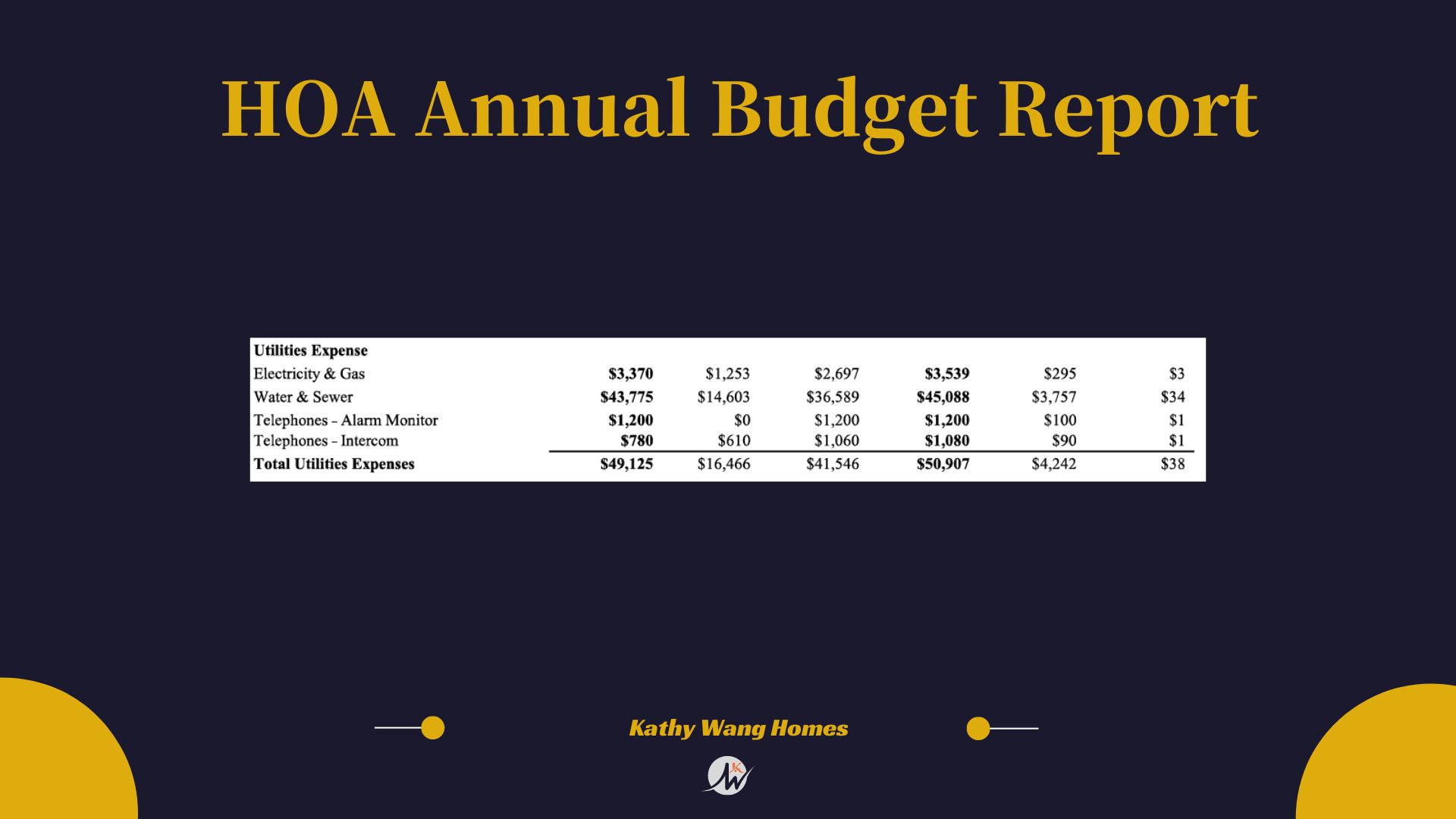

There are also Utilities Expenses, which include water and electricity bills, as well as alarm and internet costs.

The second purpose is the reserve fund. This fund cannot be used for daily expenses; it is reserved for large-scale repairs and replacements, as well as unexpected and emergency situations. For example, it covers major repairs like road maintenance or the refurbishment of community pools and tennis courts. In cases of emergencies, such as a hurricane tearing off the roof of the community clubhouse, the reserve fund would be used immediately to make the necessary repairs.

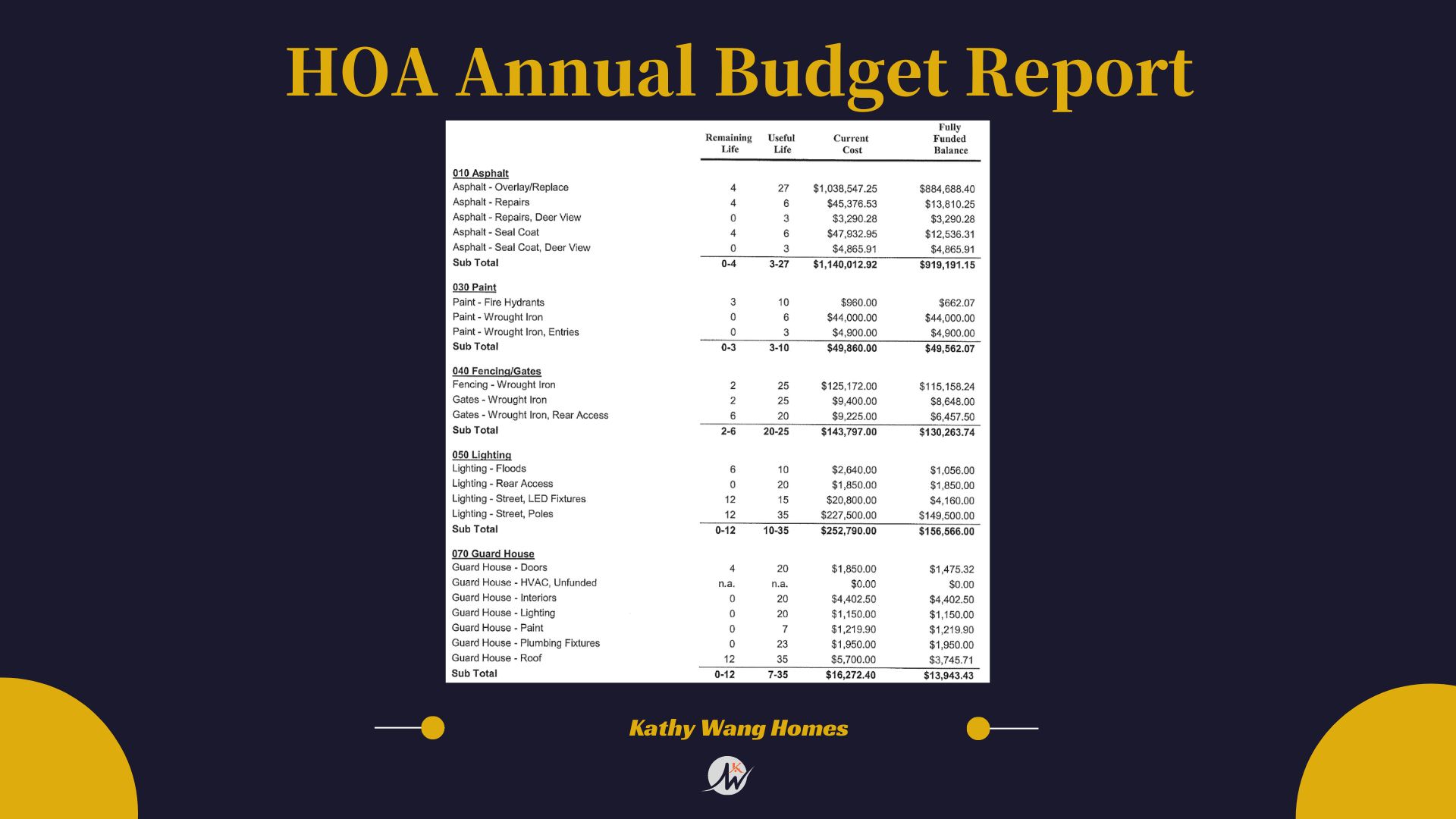

From the financial report, we can see that this community's reserve fund is allocated for the maintenance and repair of facilities such as asphalt, painting, fencing/gates, lighting, and the guard house. The report also clearly indicates the lifespan and remaining years of these public facilities.

Now that we've understood the two purposes, let's talk about the pitfalls in HOA finances. The reserve fund is similar to a savings account; this money is only used when needed. As mentioned earlier, some public facilities have a remaining lifespan of zero, indicating that immediate maintenance is required. So, the question is: is there enough money in the reserve fund?

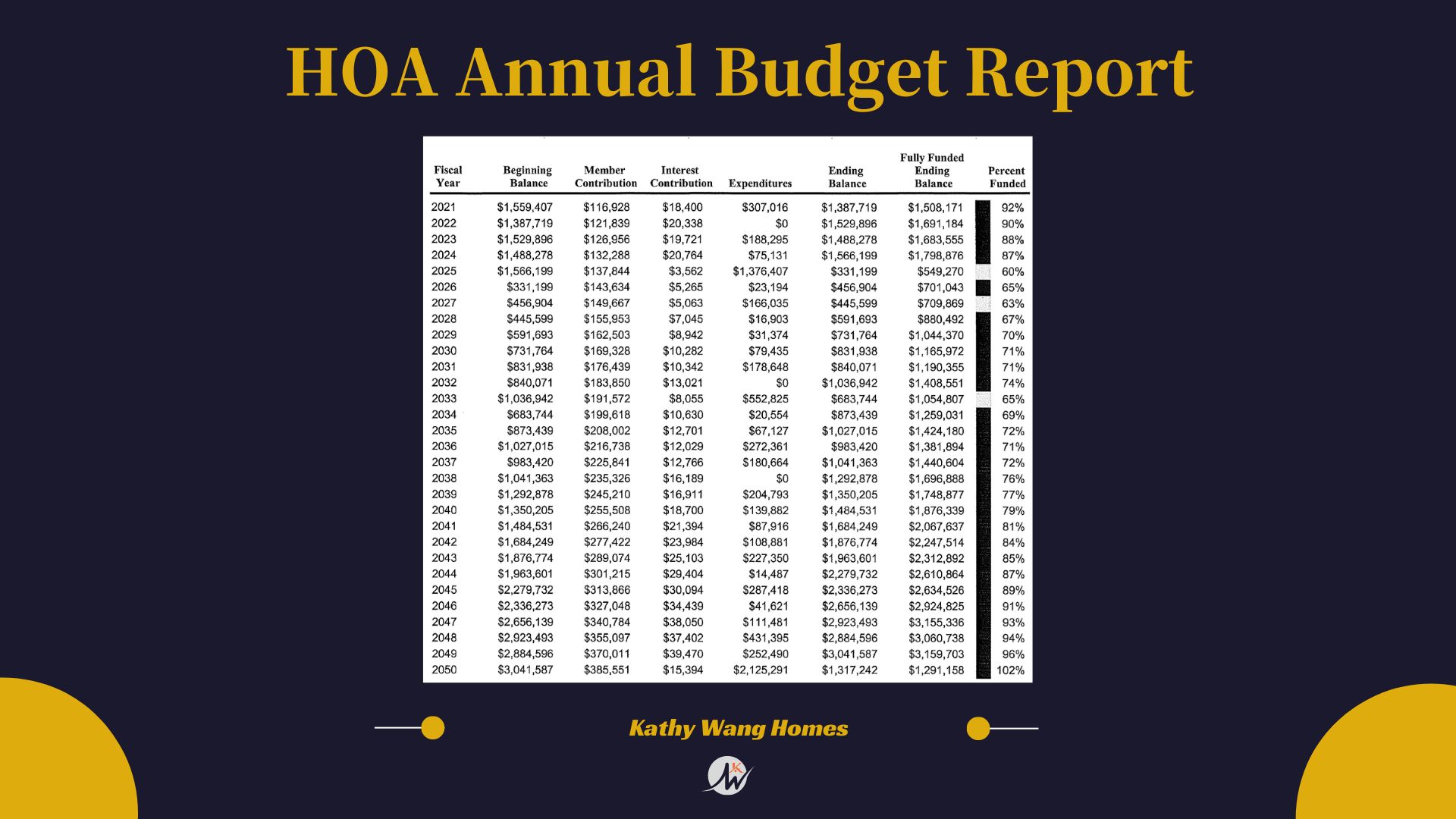

Here we look at this section, "percent funded." This percentage represents the ratio of the budget's existing reserve funds to the total required reserve funds. Generally speaking, 100% is ideal, indicating a healthy financial status. If it's below 70%, it raises a red flag, suggesting that the reserves might be insufficient. This could lead to the HOA potentially imposing a special assessment on homeowners at some point.

This report is essentially a forecast, predicting the reserve fund percentages over the coming years. Based on this percentage, one can preliminarily estimate when a special assessment might be imposed.

Regarding special assessments, according to California regulations, the HOA can impose a special assessment on homeowners without their approval, as long as it does not exceed 5% of the annual budget. For example, if the annual budget is $100,000, the maximum special assessment the HOA board can impose without member approval is $5,000. This amount is not $5,000 per household but is allocated to all units according to the distribution schedule included in the CC&Rs. Proper notice must be given to homeowners before collecting this amount. For special assessments exceeding 5%, the board must seek homeowner approval.

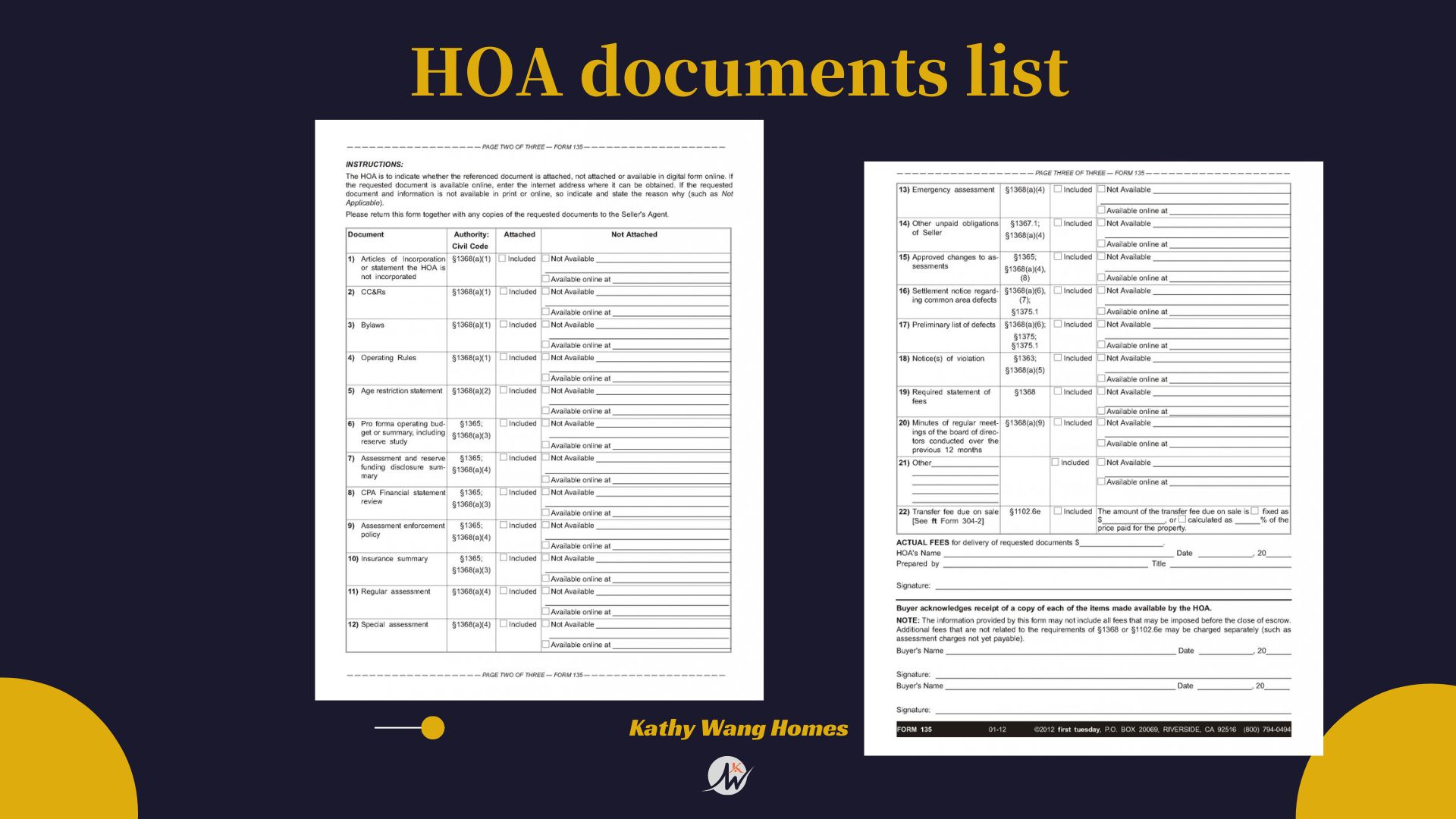

Therefore, as a homeowner, it's crucial to stay informed about significant developments within the community after purchasing a property with an HOA. Today's content helps you avoid financial pitfalls within HOA finances. There are over a dozen documents in the HOA documents, each serving different purposes. It's recommended to carefully review them before buying a home or consult me as your agent to help interpret them for you.